Home Loans And Employment Verification

Employment Verification With many businesses closed or their employees are working from home mortgage companies have been provided with alternative options to obtain employment verification. No Income Verification Mortgage Loan Programs Available Find Nationwide lenders that specialize in no income refinancing no doc mortgages and stated income home loans.

What Is A Loan Verification Purpose Uses

Employment verification 3 months after closing.

Home loans and employment verification. Verifiers love Truework because its never been easier and more streamlined to verify an employee learn more here. Asset Verification Home Buying Income Verification In order to get preapproved for a mortgage your mortgage lender will need to verify your income and asset information to determine how much home you can afford and the interest rate youll pay on the loan. Thanks to this unique loan program he was able to.

Usually your payslips tax returns group certificates or a Notice of Assessment NoA are enough. To get started now please give us a call at 925 478-8630. One step in the underwriting process is the verification of employment VOE.

Employment verification for a mortgage is one of the most crucial items on the loan application checklist so its important you understand what you need to provide the lender especially if youre self-employed as that tends to complicate things just a bit more than if you. However the lender must verify the borrowers employment for the most recent two full years and the borrower must explain any gaps in. Most mortgage borrowers rely on employment-based income to pay for a home loan.

Theyll then contact the applicant if there are any discrepancies. This was the perfect solution for our client. Mortgage lenders usually verify the amount and stability of.

Lenders will want to see that you have a steady income and make sure your employment situation. We streamline the application process keeping the paperwork required to verify your employment and income minimal on your end. It is common for quality control to pull a sampling of loans to audit in order to assure Secondary Market Investors Fannie Freddie that the loans being closed and delivered to them meet ALL Underwriting guidelines and Fed Lending Disclosure Laws.

This information is needed to verify that you earn sufficient income to make the monthly mortgage payments without enduring financial hardship. For would-be homebuyers who are still working VA lenders will need to verify your employment situation before your loan can close. One of the steps in the loan application process or even in the pre-approval stage is to verify that you have employment.

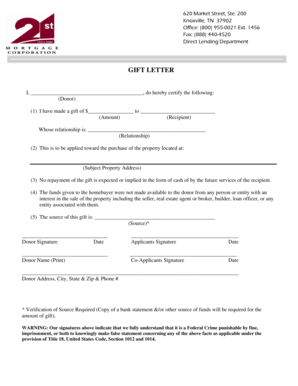

This process varies from lender to lender. However a lender may sometimes require a letter of employment for a mortgage to prove your income or use it to verify the other documents youve provided. No income or employment verification was needed and his DTI ratio was not even calculated hence why the program is called no ratio We were able to close his loan at 75 loan-to-value.

Once the lender processes the application and the applicant is ready to receive the mortgage the lender does a verbal verification of employment. Verification is at the heart of the mortgage process. The process is simple and automated and most employees are verified within 24 hours.

When you apply for a home loan the bank will need you to provide proof of your income. Typically early in the home loan process and at closing Once you have signed your initial disclosures the loan processor will likely verify employment upfront. There is a company called The Work Number owned by credit bureau Experian which offers employment verification.

VA lenders need to ensure a borrower has a steady reliable income stream thats likely to continue and that covers their future housing needs. Verifying a prospective homebuyers employment is one of the key steps of the loan process. Importance Of Income And Employment Most homebuyers depend on their incomes to pay their mortgage loan payments.

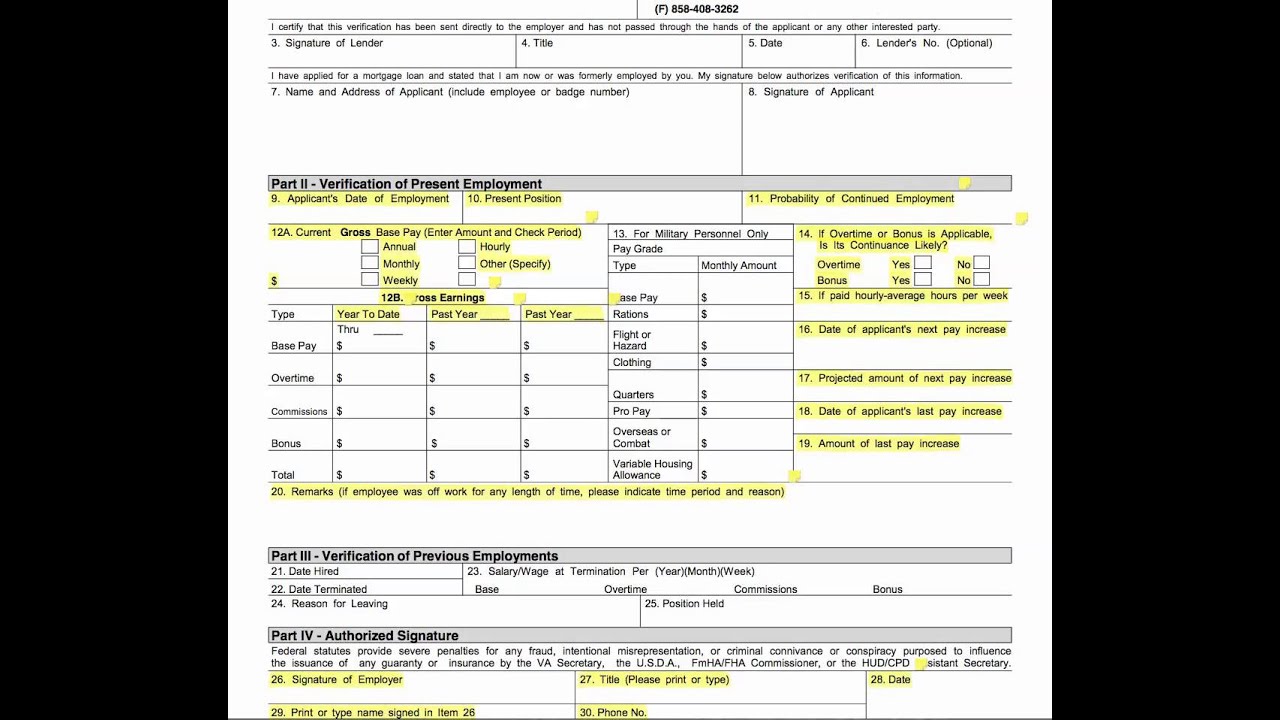

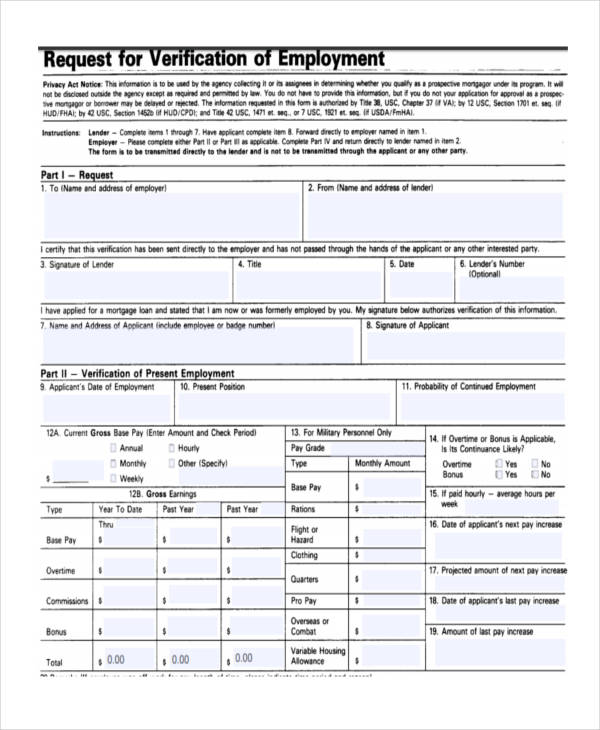

Lenders require two years tax returns two years W-2s and most recent paycheck stubs However besides just seeing their recent paycheck stubs mortgage underwriters will require employment verification which is also called VOE. To be eligible for a mortgage FHA does not require a minimum length of time that a borrower must have held a position of employment. When you apply for a mortgage the lender will need you to supply evidence of your employment status and income.

This may be nothing more than a Post Closing Audit. The mortgage lender needs to make sure you are and have been employed to ensure theyre taking into consideration all of your income sources. That way applying for a home loan is fast and easy.

Verify Veterans United Home Loans Employees Truework allows you to complete employee employment and income verifications faster. Your loan officer will notify you of the appraisal procedure that is required by your loan type. Many self-employed clients choose the no income loan options for home refinancing and house flipping loans.

This is typically a quick phone call with the applicants employer.

How To Properly Fill Out A Verification Of Employment Youtube

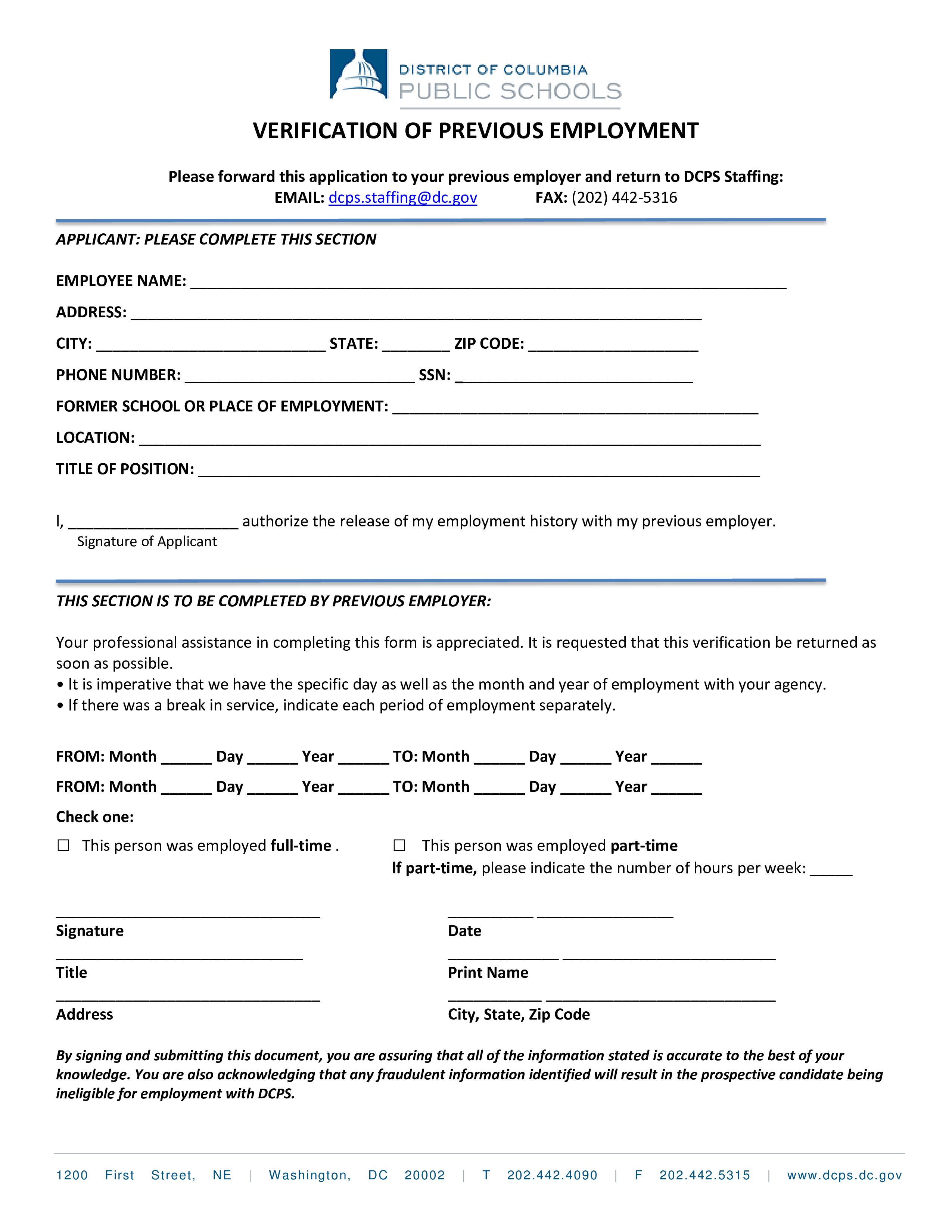

Verification Of Employment Before Closing Mortgage Guidelines

Https New Content Mortgageinsurance Genworth Com Documents Training Course Reviewcalculatebaseincome Presentation 0119 Pdf

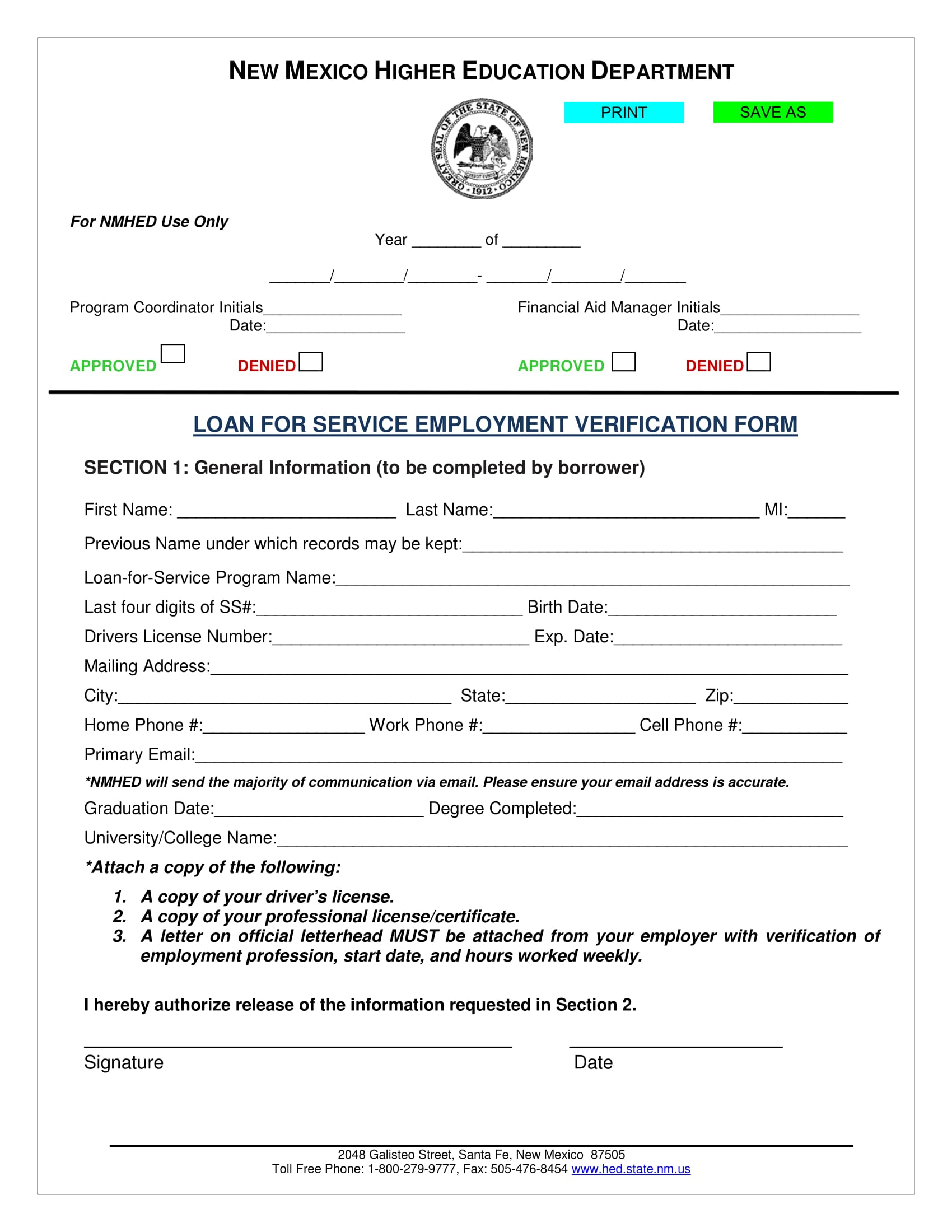

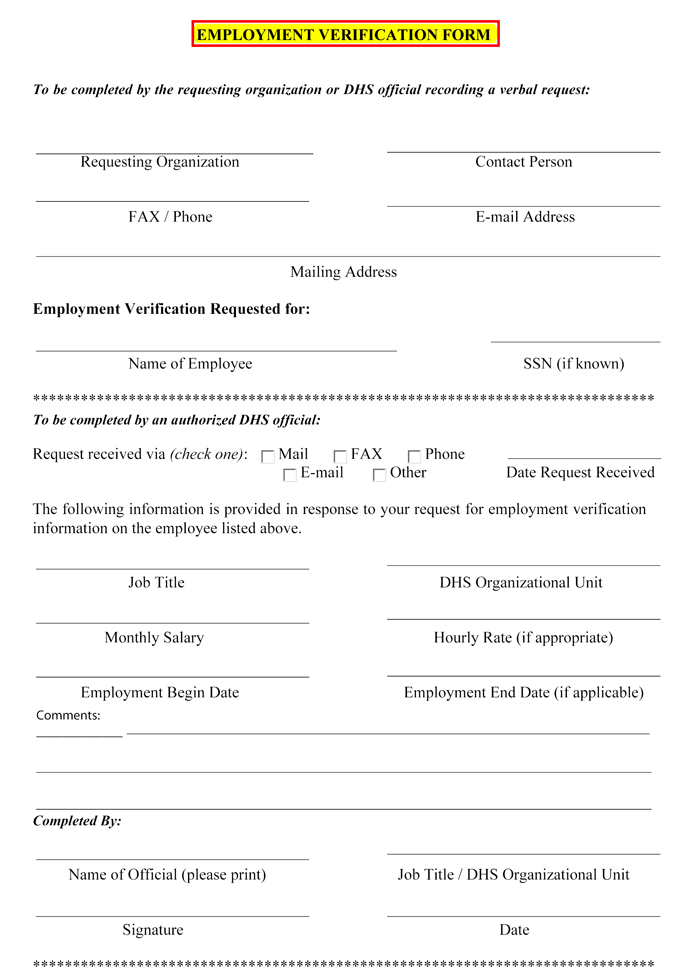

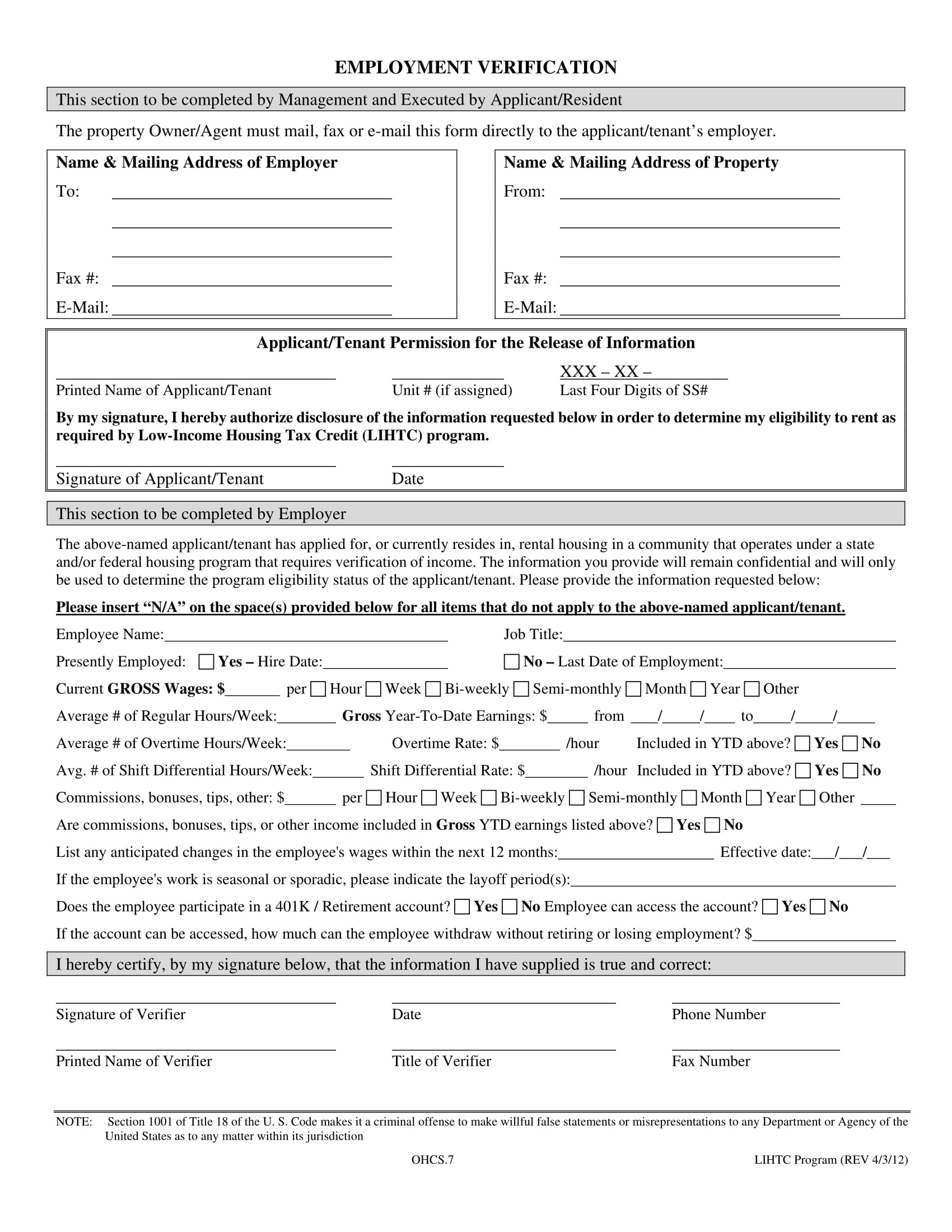

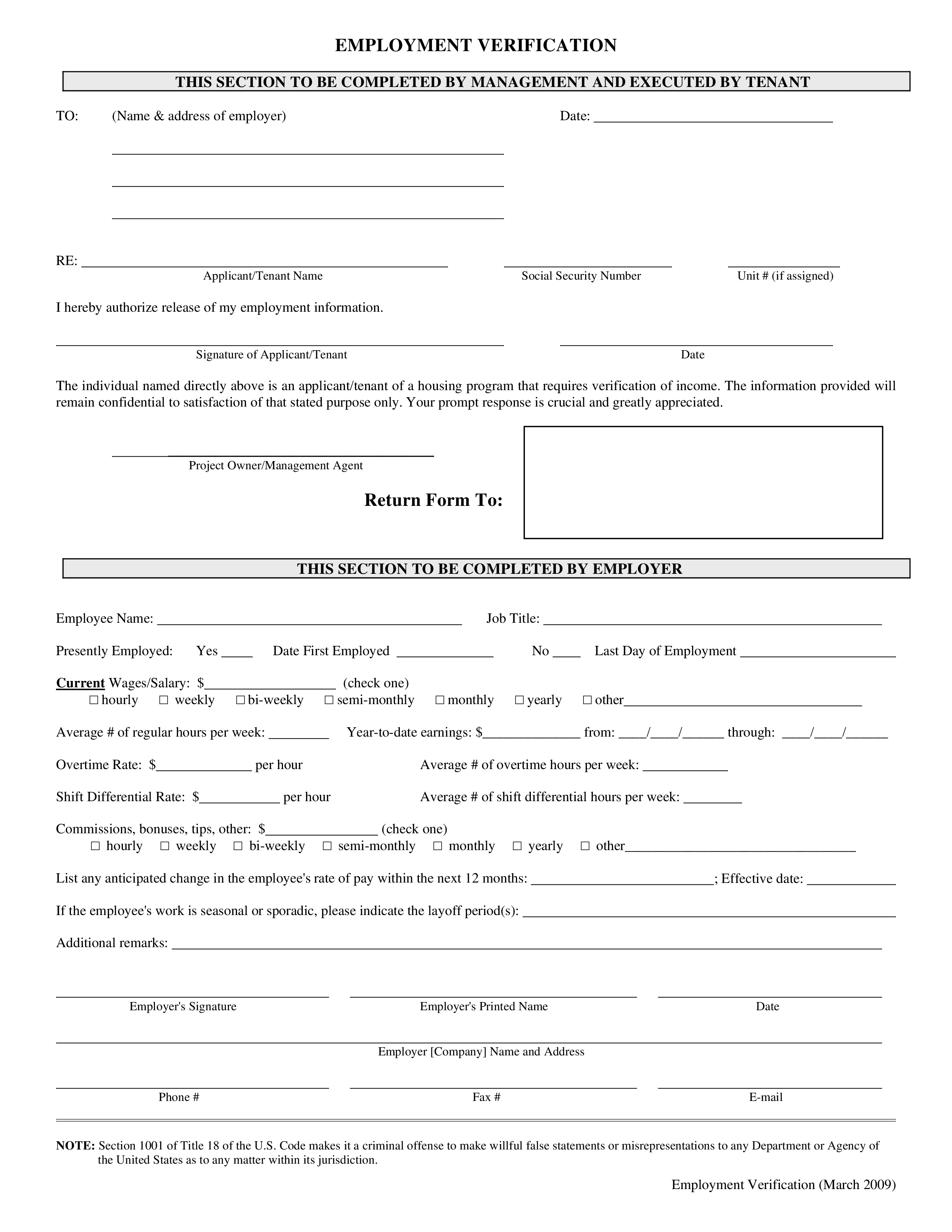

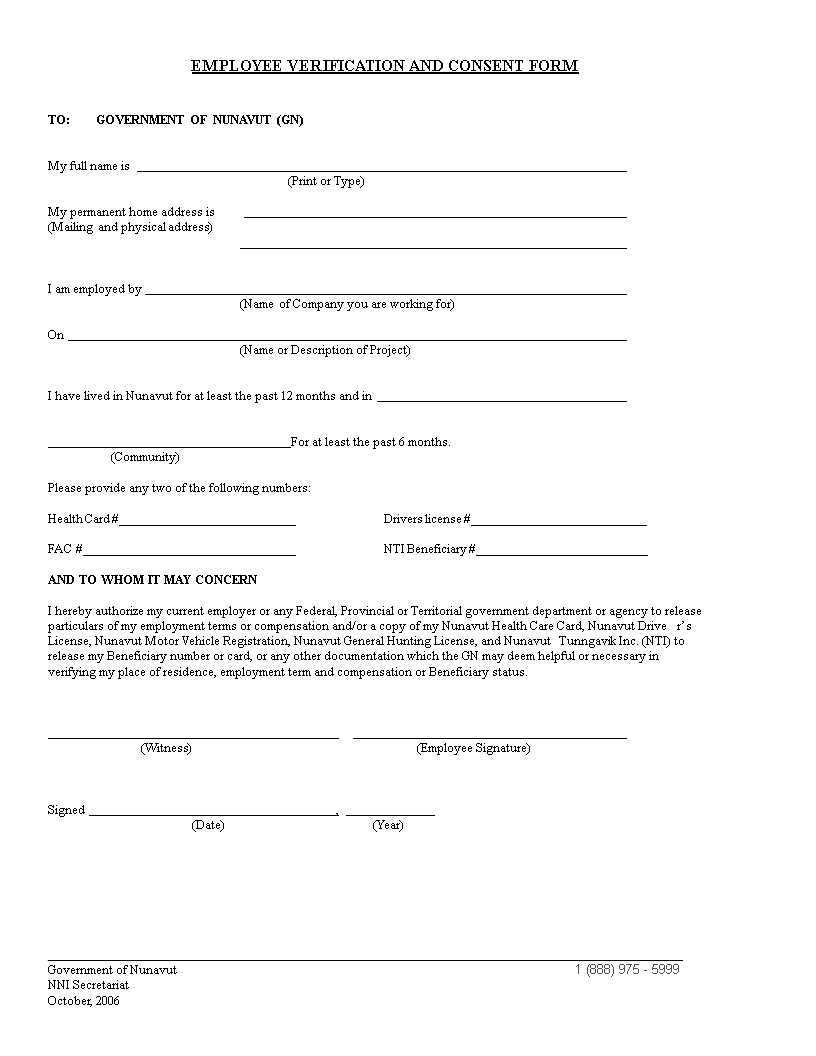

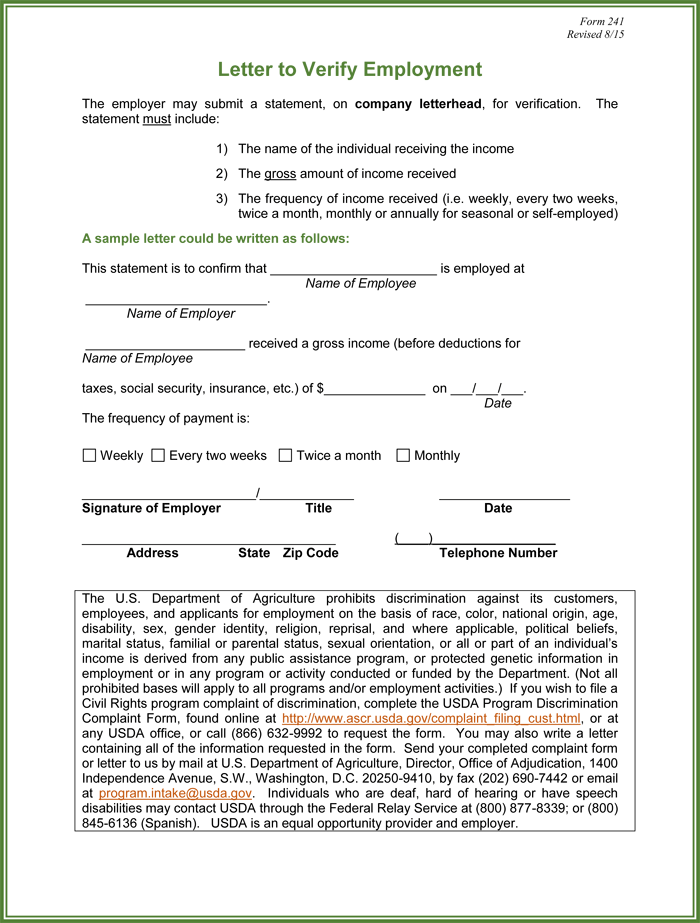

Free Employment Verification Forms And Templates

/filters:quality(60)/2020-07-09-Employment-Verification-for-Mortgage-CDN.png)

How Does Employment Verification For A Mortgage Work Ownerly

Verification Of Employment Voe For Va Loans

What Is A Tenant Employment Verification Form With Samples

What Is A Verification Of Employment Voe Blog Truework

Voe Verification Of Employment Youtube

Employment Verification Form For Apartment Rental Templates At Allbusinesstemplates Com

Voe Mortgage Fill Online Printable Fillable Blank Pdffiller

Previous Employment Verification Form Templates At Allbusinesstemplates Com

Free 8 Sample Mortgage Verification Forms In Pdf Ms Word

/preapproved_mortgage_FINAL-1ceddb3f749b4a76b1e73c0936e5bcc2.png)

Mortgage Pre Approval Home Loan Checklist

Voe Mortgage Fill Online Printable Fillable Blank Pdffiller

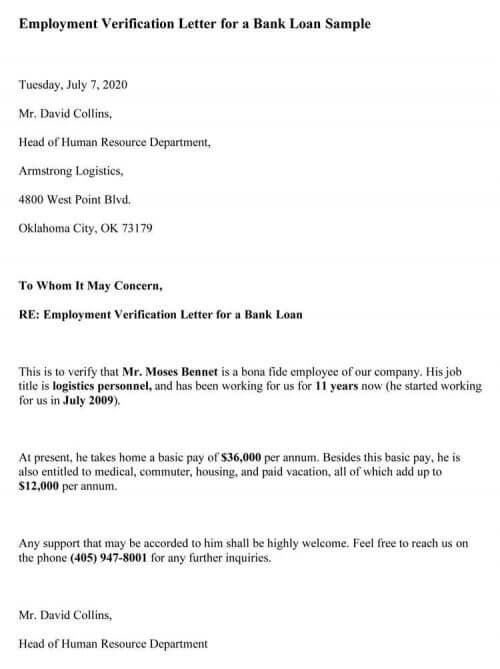

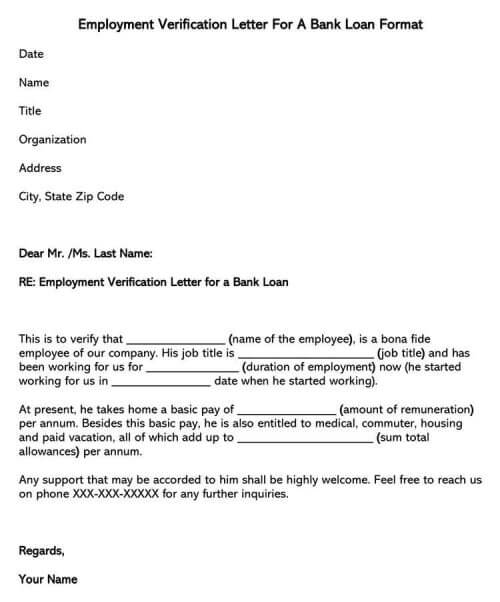

Employment Verification Letter For A Bank Loan Samples Examples

Generic Employment Verification Form Templates At Allbusinesstemplates Com

Free Employment Verification Forms And Templates

Employment Verification Letter For A Bank Loan Samples Examples

Post a Comment for "Home Loans And Employment Verification"