Fnma Guidelines Verification Of Employment

When the Seller receives employment and income verification directly from a third-party employment verification vendor FNMA is are now requiring that the information in the vendors database be no more than 60 days old as of the note date. Part I Request.

Kentucky Usda Rural Housing Loans What Are The Income And Employment Guidelines For A Kentucky Rural Develo Usda Loan Bad Credit Mortgage Mortgage Assistance

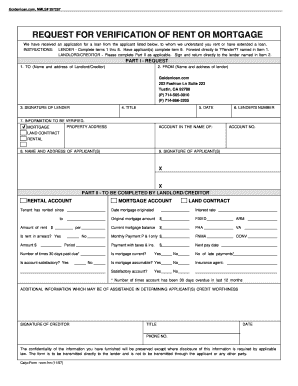

The lender may use the Request for Verification of Employment Form 1005 or Form 1005 S to document income for a salaried or commissioned borrower.

Fnma guidelines verification of employment. Individuals who change jobs frequently but who are nevertheless able to earn consistent and predictable income are also considered to have a reliable flow of income for qualifying purposes. Freddie Mac Single-Family SellerServicer Guide Bulletin 2016-23 Rev. In these cases the Selling Guide now permits this type of union to provide.

Form 1003 705 rev. Any exception to this policy must be submitted to Fannie Mae by the lender for a single loan waiver. The updated Fannie Mae Selling Guide now states that.

The form is to be transmitted directly to the lender and is not to be transmitted through the applicant or any other party. Verification of self-employment. - 32 - - 32 - LIABILITIES.

The information on the Form 1005 or Form 1005 S must be legible. DU will consider the borrower self-employed. Fannie Maes underwriting guidelines emphasize the continuity of a borrowers stable income.

If the borrower is the business owner or is self-employed and has an ownership share of 25 or more the self-employment indicator must be checked. Salary or Hourly Wage Earnings Base Income. 14 2020 and are effective until further notice.

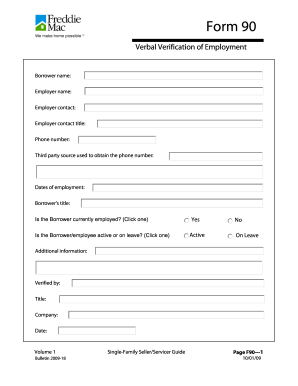

The verbal VOE must be obtained within 10 business days prior to the note date for employment income and within 120 calendar days prior to the note date for self-employment income. Forward directly to employer named in item 1. Verification of self-employment.

LenderComplete items 1 through 7. Paystubs and written verification of employment must be dated within 60 days of the Note date until further notice. These policies became effective for loans with application dates on or after Apr.

The verbal VOE requirement is intended to help lenders. For reduced hours or pay continue to follow the requirements and guidance in the Selling Guide. Have applicant complete item 8.

For details on income verification for loans with income validated through the DU Validation Service. The date of the completed form must comply with B1-1-03 Allowable Age of Credit Documents and Federal Income Tax Returns. The lender must receive the completed form back directly from the employers.

070617 Page F90-1 Verbal Verification of Employment. Has for some time permitted use of third-party data vendors to document and assess employment income and assets but the lender remained accountable for the integrity of the information obtained from these sources. Full Time For borrowers whose income is derived from full-time employment two 2 years of full employment history must be verified on FNMA Form 1005 Verification of Employment.

The lender must send the request directly to the employers. Verbal Verification of Employment. Asset Documentation Age effective for loans closed on or after 4152020 Bank statements and verification of deposits must be dated within 60 days of the Note date until further notice.

For related information refer to the IRS Form 4506-C Tips for Underwriting and Quality Control. When a borrower is using self-employment income to qualify the lender must verify the existence of the borrowers business within 120 calendar days prior to the note date. We will not permit the borrower to hand-carry the verification form.

Lenders must obtain a verbal verification of employment verbal VOE for each borrower using employment or self-employment income to qualify. Borrowers are not required to have 24 months continuous employment with their current employer. Requiring lenders to confirm the borrowers business is open and operating within 10 business days of the note date UPDATED May 5 Jun.

102716 and 121516 eff. The DU validation service extends this concept by using data from eligible verification reports assessing it in DU. 9 with new effective date UPDATED Jul.

Where there has been a change in employers in the last 24 months the borrower must explain any gap in employment. Borrower Income Verification Policies Frequently Asked Questions This document addresses frequently asked questions about Fannie Maes policies regarding verification of borrower income Selling Guide B3-3. Due to latency in system updates or recertifications.

The net income from self-employment must be entered in the Base Income field in Section V. The new policy will greatly restrict the ability to approve a loan when the borrower provides verification of employment scheduled to begin after the loan closing. EmployerPlease complete either Part II or Part Ill as applicable.

If a recent paystub or bank statement is obtained in lieu of the verbal verification of employment VOE and the documentation evidences reduced hours andor pay due to the pandemic what are the next steps. Posted by It is always. The verbal verification of employment for a union member who is currently employed and an executed employment offer or contract for future employment for a union member who is not scheduled to begin employment until after the loan closes.

Complete Part IV and return directly to lender named in item 2. All other existing requirements for employment offers or contracts described in. The completed form should not be passed through the applicant or any other party.

The stable and reliable flow of income is a key consideration in mortgage loan underwriting.

Fannie Mae Request For Verification Of Employment Verification Of Employment Pdf4pro

Fannie Mae Form 1005 Fill And Sign Printable Template Online Us Legal Forms

Https Singlefamily Fanniemae Com Media 23906 Display

Verification Of Mortgage Form Fill Out And Sign Printable Pdf Template Signnow

Https New Content Mortgageinsurance Genworth Com Documents Training Course Reviewcalculatebaseincome Presentation 0119 Pdf

Fannie Mae Previous Employment Verification Jobs Ecityworks

Https New Content Mortgageinsurance Genworth Com Documents Training Course Reviewcalculatebaseincome Presentation 0119 Pdf

Fha Streamline Refinance Fha Streamline Refinance Fha Mortgage Fha Streamline

Https Singlefamily Fanniemae Com Media 23906 Display

Verification Of Employment Form Fill Out And Sign Printable Pdf Template Signnow

Https New Content Mortgageinsurance Genworth Com Documents Training Course Reviewcalculatebaseincome Presentation 0119 Pdf

Verification Of Employment Form 1005 Pdf Fannie Mae Verification Of Employment Form 1005 Pdf Fannie Mae Pdf Pdf4pro

Fannie Mae Request For Verification Of Employment Verification Of Employment Pdf4pro

Https Singlefamily Fanniemae Com Media 23906 Display

Verification Of Employment Form 1005 Pdf Fannie Mae Verification Of Employment Form 1005 Pdf Fannie Mae Pdf Pdf4pro

Louisville Kentucky Va Home Loan Mortgage Lender Kentucky Va Facts Mortgage Loans Home Loans Mortgage Lenders

Https New Content Mortgageinsurance Genworth Com Documents Training Course Reviewcalculatebaseincome Presentation 0119 Pdf

Https New Content Mortgageinsurance Genworth Com Documents Training Course Reviewcalculatebaseincome Presentation 0119 Pdf

Post a Comment for "Fnma Guidelines Verification Of Employment"